February 2025 Real Estate Update, Market Shifts, Rates, And What To Watch

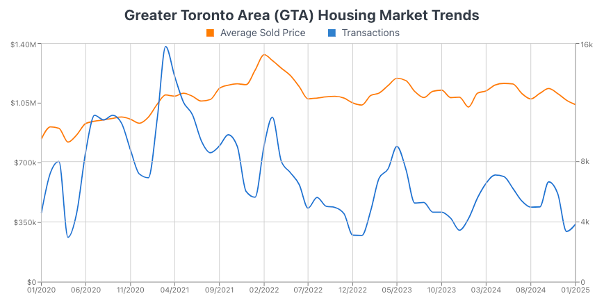

Market Snapshot

Recent activity shows a market that is gradually tilting in favour of buyers.

• Monthly Transactions: +14.5%

• MLS Benchmark Price: +0.8%

• Median Home Price: -2.2%

• Market Condition: Buyer’s Market

Lower mortgage rates following recent Bank of Canada cuts have encouraged more sellers to list their homes. Inventory is rising, giving buyers more choice and more room to negotiate.

As rates continue to ease, more buyers may re enter the market, which could support demand later this year. At the same time, higher inventory levels may lead to longer listing periods and softer pricing in the near term. Sellers who price competitively and prepare their homes well are likely to stand out more easily.

What This Means For You

For buyers, increased selection and lower rates can create opportunities for stronger negotiating positions and better overall value.

For sellers, more competition means pricing strategy, preparation, and presentation matter more than they have in recent years.

Homeowner Tips Of The Month

A couple of simple seasonal reminders that can make a difference.

• Ceiling fans: Set fans to spin clockwise at a low speed during winter to push warm air back down and help reduce heating costs.

• Attic check: Ice dams are often a sign of insulation or ventilation issues. A quick look now can help prevent problems when temperatures start to fluctuate.

Mortgage And Rate Update

• Prime Rate: 5.20%

• Best 5 Year Fixed: 4.09%

• Best 3 Year Variable: 4.45%

• Next Bank of Canada Rate Announcement: March 12, 2025

On January 29, 2025, the Bank of Canada lowered its policy rate by 25 basis points to 3.00%. While rate cuts can take 12 to 18 months to fully work through the economy, this shift has already influenced borrowing conditions.

With roughly 60% of Canadian mortgages renewing over the next two years, many homeowners will be renewing for the first time since rates rose sharply in 2022. Reviewing renewal options early and understanding available strategies can help reduce surprises.

In The News

Could a U.S. Canada trade dispute impact housing?

The Bank of Canada has noted that even the possibility of new tariffs is slowing economic activity. A broader trade conflict could weaken GDP, increase inflation pressures, and put downward pressure on the Canadian dollar. If tariffs were introduced, further rate cuts could follow, potentially lowering fixed mortgage rates.

Rent prices fall to an 18 month low

Canada’s average rent dropped to $2,100 in January 2025, down 4.4% year over year, marking the fourth consecutive monthly decline. Ontario saw the largest decrease at 5.2%, offering renters more flexibility after several tight years.