February 2026 Housing Market Update: Prices, Renewals & Affordability

February continues to reflect a housing market shaped primarily by affordability, supply levels, and household finances. Below is a detailed review of current market conditions, borrowing trends, and developments worth noting.

Housing Market Update, Early 2026

The housing market continues to move through a demand-constrained adjustment period, with affordability and household finances remaining the dominant forces.

Nationally, sales activity has remained below long-term averages, while inventory continues to build and homes are taking longer to sell. Buyers now have more time, more choice, and increased negotiating leverage compared to recent years.

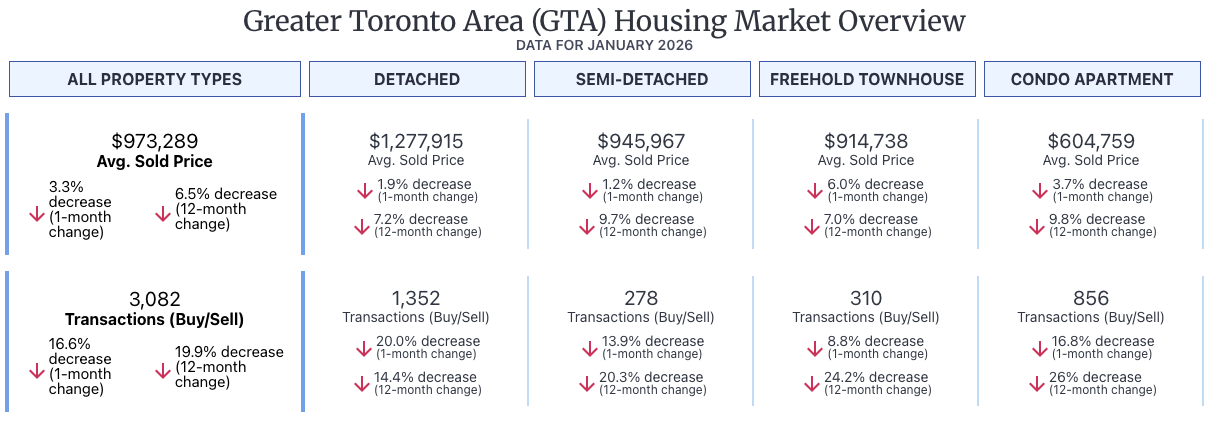

In the Greater Toronto Area, recent data shows:

Benchmark price: $936,100, marking the eighth consecutive monthly decline and bringing values to their lowest level since early 2021

3,082 homes sold in January, down nearly 20% year over year

Homes selling for approximately 97% of asking price, compared to roughly 99% last year

Average days on market: 67 days, up from 55 days last year

Although borrowing costs have eased from peak levels, affordability remains constrained. Income growth has not kept pace with home prices, limiting how many buyers can enter the market.

Another shift is the decline in flipping and speculative demand. House flipping activity has dropped as higher carrying costs and tighter lending conditions reduce short-term resale viability.

Looking ahead, activity may increase modestly as the year progresses. Current data continues to indicate a negotiation-driven environment shaped by supply levels and household financial pressure.

Key takeaway: Affordability, renewal pressure, and inventory levels remain the primary variables influencing market conditions in 2026.

Interest Rates and Borrowing Update

The Bank of Canada held its policy rate at 2.25% at its January meeting, and most forecasts expect rates to remain relatively stable through 2026.

When rate expectations stabilize, urgency tends to moderate and demand moves at a more measured pace.

At the same time, roughly 60% of Canadian mortgages are expected to renew at higher rates than their previous term. This renewal cycle represents a meaningful adjustment for many households and may influence housing decisions throughout the year.

Many current fixed mortgage rates are now below 4%, meaning borrowers who secured financing at higher levels may benefit from reviewing available options. Comparing lenders, reviewing term length, and aligning mortgage structure with future plans can reduce monthly payments and overall cost.

Top Headlines

RBC and Realtor.ca Partnership:

RBC has entered into a strategic arrangement with Realtor.ca to integrate financial tools and mortgage-related resources directly into the home search experience. As technology continues to influence how buyers research homes, this development may improve access to affordability tools and financing guidance earlier in the process.

Read the full article.

Save Max Trust Account Breach:

RECO recently suspended a Mississauga-based Save Max brokerage after approximately $2.7 million was unlawfully borrowed from client trust accounts, which are required to remain fully segregated from brokerage operating funds. Regulatory action was taken promptly.

Read the full article.

Homeowner Tips

As winter transitions, February is a practical time to review:

Furnace filters and HVAC servicing

Rooflines and attic ventilation

Basement moisture monitoring

Sump pump function before thaw

If you would like a structured reference for seasonal upkeep, you can access my home maintenance checklist here.

Important Dates You Should Know

March 2 - RRSP contribution deadline

March 18 - Bank of Canada rate announcement

April - Spring market activity typically develops

Tech to Watch: AI Agents

AI tools are beginning to move beyond chat and into systems that can complete defined tasks automatically, from drafting documents to managing simple workflows. Platforms such as Claude are early examples of this development. For business owners and professionals, these tools may be worth exploring as practical applications expand over the next year.

Learn more here.

Let’s Connect

If you are renewing this year, reviewing timelines, or reassessing your position in the current market, I’m happy to chat.